Confirmed: Treasury Says Obama Stole From Fannie, Freddie Investors to Fund Obamacare

Jerome Corsi | Infowars,

Docs reveal Obama defrauding mortgage investors.

WASHINGTON, D.C. – A careful analysis of the Treasury Department’s “Agency Financial Report for Fiscal Year 2013” provides evidence the Obama administration stole from Fannie and Freddie investors to fund Obamacare.

Guided by a CPA, who worked for two years for a major U.S. accounting firm as an outside auditor for Freddie Mac, Infowars.com has documented in the Treasury Department’s 2013 financial reports how the Obama administration diverted into Obamacare billions of dollars that Treasury confiscated from Freddie and Fannie earnings.

On Aug. 17, 2012, the Obama administration finalized the amendment of the Treasury Department’s Senior Preferred Stock Agreements with Fannie and Freddie that deprived private and institutional investors of their legally due dividend payments.

This enabled the Obama Treasury Department to confiscate billions of dollars in Fannie and Freddie earnings, in what is known as the “Net Worth Sweep,” or NWS.

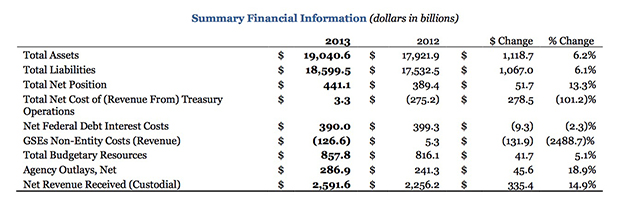

The analysis begins with a table entitled “Summary Financial Information,” presented on page 26 of the Treasury Department’s “Agency Financial Report for Fiscal Year 2013.”

Note the line item “GSEs Non-Entity Costs (Revenue)” that records the flow into Treasury of the funds confiscated by the Obama administration in the NWS: recorded in 2012 as a cost to the treasury of $5.3 billion.

This line item dramatically reverses in 2013 to reflect the NWS revenue inflow from the two Government Sponsored Entities, GSEs, amounting in 2013 to $126 billion.

Treasury also revised their 2013 internal estimate of GSE liabilities from a liability of $288.7 billion in 2012, to a much-reduced liability of $9 billion in 2013 — a difference explained entirely by the Net Worth Sweep.

The second paragraph of the “Financial Overview” below the chart leaves no doubt, reading as follows:

“Additionally, the Department amended its Senior Preferred Stock Purchase Agreements (SPSPAs) with Fannie Mae and Freddie Mac – two Government-Sponsored Enterprises (GSEs) – in 2012, which changed, among other things, the basis for determining quarterly dividends that are paid by the GSEs to the U.S. government commencing with the quarter ending March 31, 2013. As a result of the amended SPSPAs, coupled with the GSEs’ long-term financial forecasts within a specific time horizon, the Department reduced its contingent liability associated with the GSE program by $9.0 billion and $288.7 billion at the end of fiscal year 2013 and 2012, respectively, via a reduction in expense.”

The $126.6 billion that Treasury received from the Fannie and Freddie NWS is also noted in the “Consolidated Statements of Net Cost for the Fiscal Years Ended Sept. 30, 2013 and 2012” that the report publishes on page 50.

The explanation of the $126.6 billion in Treasury revenue received from the GSEs is further elaborated in the following paragraph that appears on page 29 of the report:

“GSE Non-Entity Revenue totaled $126.6 billion for 2013 compared to net cost of $5.3 billion for 2012. The revenue in 2013 was primarily driven by a $77.3 billion increase in preferred stock dividends, coupled with a $30.9 billion valuation gain on GSE investments in 2013 compared to a $42.3 billion loss in 2012. These increases primarily stemmed from federal income tax benefits and other improvements in the GSEs’ financial performance in 2013.”

On page 94, the report provides a chart detailing that the $126.6 billion in GSE revenue came from preferred stock dividends and from the market fair value gain on the preferred stock Treasury held in Fannie and Freddie,

Continue here: https://www.infowars.com/treasury-report-obama-stole-from-fannie-freddie-investors-to-fund-obamacare/