Fixing the GOP Tax Plan

Wayne Allen Root,

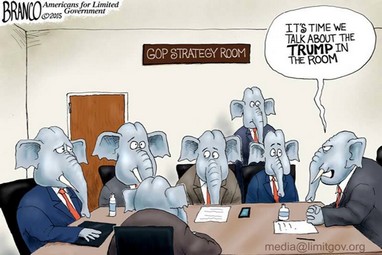

In my last column, I told you all the problems I’ve found in the GOP tax cut plan. It’s the first tax cut plan in my lifetime that I’m not excited about. The GOP is making a big mistake- unless big changes are made. But I remain hopeful those changes are on the way.

President Trump came up with a great idea- stimulate the economy by passing the largest tax cut in history. But as usual, this idea has been high-jacked by lawyers, lobbyists, consultants and billion dollar multi-national corporations. So now instead of a much-needed tax cut for everyone, it’s mostly a big tax cut for corporations and a very small tax cut for small business and individuals. So, Congress is once again screwing over the little guy.

President Trump specifically wanted a special new tax rate for small business owners (like me). Because we are the economic engine of America, risk our own money to fund our businesses, work long hours, and create a large majority of new jobs, Trump agreed we deserve a break.

Hence the special 25% tax rate for small business owners. Great! Except Congress created a special tax rate that only applies to 30% of a small businessperson’s income. The other 70% gets taxed at the highest personal rate. Really? And the top personal rate is still 35%.

But isn’t the claim by billionaire CEOs that a 35% corporate tax rate is so high, they are being forced to move their companies out of America? And yet 35% is supposed to be fine for individuals?

And because you’re lowering our top tax rate from 39% to a measly 35%, you’re taking most of our deductions away? Thanks for nothing.

So rather than complaining, allow me to provide the solutions.

I’m looking for reasons to support this GOP tax plan. I’m looking for reasons to sell it to the millions of conservatives who listen to my national radio show on USA Radio and my national TV show on Newsmax TV. Here’s how to make it happen.

*Keep the mortgage interest deduction intact. This is the most important tax deduction on the planet for millions of American homeowners, and real estate professionals. All of them vote. If the GOP wants to win elections, override the House version and keep the mortgage deduction.

*Keep the property tax deduction. I would suggest eliminating the state income tax deduction, but compromise by keeping in the full property tax deduction. State income tax is a choice. You can choose to live in a high tax state like New York or California. Or you have the freedom to escape to places like Nevada, Texas, Florida or Tennessee, where state income taxes are zero.

But everyone pays property taxes. How could millions of American homeowners afford to pay a federal income tax on money they’ve already used to pay their property taxes? Paying taxes on taxes? The Founding Fathers must be rolling over in their graves.

By the way, if eliminating the property tax deduction is such a great idea, why does this GOP tax plan still allow corporations to deduct 100% of their state and local taxes?

The compromise is so simple. Eliminate the state income tax deduction for everyone- both companies and individuals. But retain the full 100% property tax deduction for everyone.

*Keep the medical expenses deduction. Because of Obamacare, healthcare costs are the highest in history. They are eating up all the money in the budgets of middle class Americans. Yet at this moment in time the House chooses to eliminate any deduction for these expenses? The DC swamp lives in a different world than the rest of us.

*Equalize the tax treatment of big business and small business. Apply that special 25% tax rate for “pass through businesses” to all of their income. If you have to raise more revenues to accomplish that, simply raise the corporate rate from 20% to 23%.

Simple fixes. Make these changes and I’m “all in.” I’m still unhappy with the high tax rates for individuals. Just be sure that President Trump comes back by 2020 with a much bigger reduction in individual rates- just as Reagan did the second time around.

Make these changes and Trump wins re-election by a wide margin.