Economic Sentiment Reaches Record High #TrumpLove

Louis Basenese,

Dear Wall Street Daily Reader,

It’s Friday. And you know what that means in the Wall Street Daily Nation.

It’s time for our weekly dose of graphics to drive home a point or two.

This go-round, I’m taking aim at the pessimists.

As you’ll see in a moment, they’re in short supply, and that could have a profound effect on where the economy and the stock market head next. So pay attention… or miss out!

Let the Good Times Roll

Optimism can be a powerful economic force. That is, as long as all the good feelings translate into good actions. Like increased capital expenditures and hiring.

I’m bringing this up because optimism (suddenly) abounds.

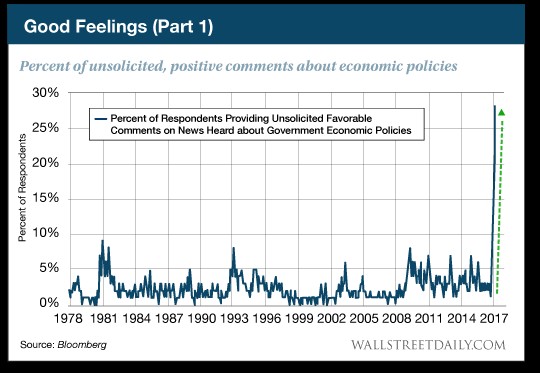

Case in point: In February, 28% of respondents in the University of Michigan Consumer Sentiment survey voluntarily mentioned news about the government’s economic policy in a positive light. That’s a record high — and miles above previous surges, too.

Clearly, President Trump’s pro-growth, anti-regulation rhetoric is resonating. (Maybe #TrumpLove will go viral soon.)

If you’re a pessimist — and tempted to immediately discard this data point as an outlier — don’t!

The latest reading of Gallup’s U.S. Economic Confidence Index also surged — up 7 points, to a +16 reading. That’s the highest weekly average in roughly the last decade:

Again, all these good feelings are meaningless unless they translate into positive action. Time will tell. But I’m feeling optimistic!

One for the Record Books

Considerable ink is being spilled about the ever-lengthening streak of days without a 1% drop for the S&P 500 index.

Why? Because we recently crossed the 100-trading-sessions mark, which puts us within spitting distance of the next longest streak at 112 straight days without a 1% decline.

It’s only a matter of time before volatility returns. As the two-year chart of the VIX volatility index shows, every four–five months, we get a sudden uptick in nervousness:

Many believed this week’s Fed decision would cause a spike. Not so much. Rest assured, though, one is coming.

When it does, the best response isn’t to join the pessimists and panic that a massive sell-off is starting. Instead, we should pounce on the pullbacks in already undervalued securities. If you don’t have any of those on your watch list, we can help.

Our premium newsletter, True Alpha, focuses on finding high-growth, undervalued small-cap stocks. And we’re broadcasting our latest monthly issue later today, with full details on the newest opportunity. Don’t miss out. Sign up here [2] for a free trial.

Smart Investing,

Louis Basenese

Investment Director, Wall Street Daily