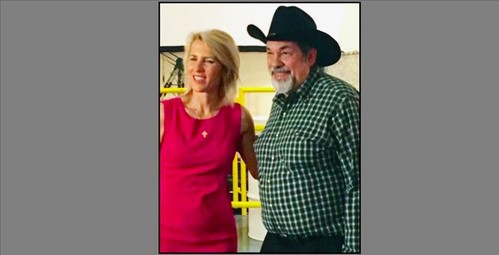

Laura Ingraham, Gold and Donald Trump

Last week, I was invited to attend the 2017 Texas Energy Museum “Blowout,” where Laura Ingraham was the featured speaker. She told us that she is considering a run for the U.S. Senate from the state of Virginia next year, running against Democrat Tim Kaine, who was Hillary Clinton’s running mate in 2016. I had a chance to chat with Ms. Ingraham before her talk and encouraged her to run for the Senate.

One reason why I want Laura Ingraham to run for the Senate is that we need sound-minded conservatives at every level of government – state legislatures, governors’ mansions, the House, Senate and White House.

Gold rose and stocks fell last week. As we near the end of the first quarter (this Friday), it appears that gold and silver will once again beat stocks in the first quarter. As we mentioned last week, gold often falls in advance of a Federal Reserve rate increase but then rallies after the increase is announced. In the latest instance, Fed chair Janet Yellen stressed the “gradual” nature of this year’s rate increases, meaning they won’t raise rates at every one of their eight annual meetings, but perhaps only two more times this year.

Last week, there was a great deal of celebration among mainstream media pundits about Donald Trump’s failure to persuade enough Republicans to back his “repeal and replace” Obamacare bill, but the “death of the Trump agenda” may be premature, or at least exaggerated. This roadblock could eventually be a win for Trump when Obamacare starts to unravel of its own accord, but more importantly this apparent setback will encourage the Trump team to undertake far more urgent efforts in tax reform, deregulation and infrastructure spending. All three moves will be good for business but they will also tend to increase the deficit. If history is any indication, the first two years of a new president’s term is the most important, because that’s when he has majority control of Congress – a situation that could be reversed after 2018.

President Trump may turn out to be another Big Spender. He has espoused many high-spending programs that will inevitably bloat the federal budget deficit. In his speech to Congress and the nation on February 28, for instance, President Trump announced the biggest-ever one-year increase in defense spending (+$54 billion) along with a multi-trillion-dollar new infrastructure plan, plus a laundry list of several other new programs, including a long border wall with Mexico that will most likely incur massive cost over-runs.

In addition, higher interest rates – instituted by the Federal Reserve – will cause the interest on the federal deficit to start rising again. Interest on the $20 trillion public debt may double or triple in Trump’s first term alone. Like President Obama, who also passed several new high-spending programs in this first term, we could see a return of $1 trillion annual deficits, which Obama ran up from 2009 to 2012. It’s no coincidence that those are also the years in which gold gained the most ground, from $1,000 to $1,900.

We also need to pay attention to elections in France on April 23, with a likely runoff on May 7. The leading candidate, Marine Le Pen, is in favor of leaving the European Union (EU), which could devastate the euro currency. That means gold could soar in euro terms if the EU dissolves after a French exit (“Frexit”) from the EU. Then, in September, mighty Germany will vote on a new Chancellor. Any major changes of power in Europe could lead to rising global uncertainty, which is a winning formula for gold.

There’s another reason why gold has a good chance of rising under Trump, and that’s because gold tends to rise in the first year of new presidents, especially those from a new party. For instance, gold rose 23% in Jimmy Carter’s first year (1977), 18% in Bill Clinton’s first year and 25% in Barack Obama’s first year. Trump is as controversial as Carter, Clinton or Obama, so gold could rise strongly in his first year.

Major Foreign Banks Still Favor Gold

The Dutch bank ABN AMRO expects gold to rise to $1,400 this year based on improving jewelry demand and rising investor demand vs. a slower rise in supply. Georgette Boele, ABN AMRO’s coordinator for foreign exchange and precious metals strategy, said that 2017 would mark the first time in five years that demand will outstrip supply. However, she says, the supply shortage probably won’t last long because a rise above $1,400 would likely result in more scrap gold coming out of hiding, adding to total supply.

Germany’s Commerzbank is usually friendly to gold. Last week they said $1,250 gold is just a “speed bump, not a roadblock. “Although this psychologically important threshold appears to be posing something of a challenge in the short term, the chances of the price rising above it are good.” Citing the renewed inflow into gold ETFs, the bank said “there is ample upside potential” since “speculative financial investors in particular are likely to jump back onto the bandwagon” after the Fed raised rates.

Canada’s investment bank TD Securities thinks the “dovish” comments by the Fed after its recent rate increase have given gold a second wind. In addition, TDS analysts wrote, “The world continues to face numerous risks ranging from potentially destabilizing French elections, to trade/currency wars with China and Mexico, to President Trump’s inability to deliver on his fiscal agenda.” Also, “disappointing U.S. earnings projections and potential economic data disappointments could again attract investors into gold.”

In addition, the Central Bank of Russia added 300,000 Troy ounces of gold (9.33 metric tons) to its foreign exchange reserves in February, after adding 37 metric tons in January. The latest purchases take Russia’s gold reserves up to 1,654 metric tons, the sixth largest gold owner in the world, just behind China. Russia is now on a path to pass China in gold holdings by the end of 2017, according to Lawrie Williams of Sharps Pixley in London. Russia is now just 188 metric tons behind China in gold holdings.

Massive Gold Coin (Worth over $4 Million) Stolen from German Museum

A massive (220-pound) pure (.99999) 24-karat gold coin bearing the Queen’s image on one side and the Canadian Maple Leaf on the other was stolen from a German museum on Monday, according to the BBC and other European news sources. The coin was minted by the Royal Canadian Mint in 2007. It has a face value of $1 million, but 100 kilograms of pure gold is worth $4 million in melt value at $1,245 per ounce, and with so much pure gold in a unique numismatic strike, the coin is likely worth well over $4 million.

The huge (21-inch diameter) coin was stolen from the Bode Museum in Berlin at around 3:30am Monday. Since a ladder was found on the train tracks nearby, police believe the thieves entered through a window. The coin was secured with bullet-proof glass inside the building, but German authorities declined to reveal further details about the security or alarm systems. The Bode Museum holds over 540,000 objects, but the “Big Maple Leaf” seems to have been the only item stolen, according to German media reports.