Manufacturing in U.S. Almost Stalls as Global Slowdown Spreads

American manufacturing barely grew in September as a broader swath of industries suffered from the effects of a strong dollar and faltering overseas markets.

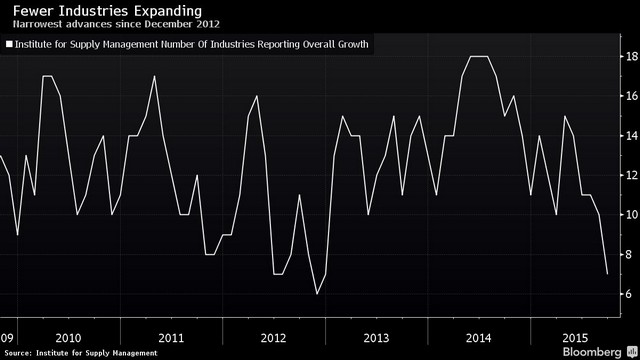

The Institute for Supply Management’s

factory index fell to 50.2, the weakest since May 2013, from 51.1 in August, the Tempe, Arizona-based group reported Thursday. Fifty is the dividing line between expansion and contraction. Just seven of 18 industries grew last month, the fewest since December 2012.

What started out as oil-related weakness among energy companies is now spreading to computer, plastics and machinery makers as the

stronger dollar combined with slower growth in emerging markets hurts

foreign sales. One saving grace is American consumers, whose spending — braced by an improving job market — is bolstering auto dealers and construction companies.

Manufacturing is “clearly the weakest part of the economy,” said

Jim O’Sullivan, chief U.S. economist at High Frequency Economics Ltd in Valhalla, New York, who is among the best forecasters of the factory index, according to data compiled by Bloomberg. It’s “highly exposed to foreign demand, and exports are declining.”

The

median forecast of 85 economists surveyed by Bloomberg projected the ISM index would fall to 50.6. Estimates ranged from 49 to 52.

Orders, Employment

Last month’s slowdown was paced by weakening orders and employment. The ISM’s bookings measure dropped to 50.1, the lowest level since November 2012, while hiring proceeded at the slowest pace in five months.

With orders barely growing and backlogs diminishing, output will probably slow in coming months,

Bradley Holcomb, chairman of the ISM factory survey, said on a conference call with reporters.

Shrinking order books “will relate to production in the future as much as anything else,” he said. Manufacturing is clearly “moving into a soft territory.”

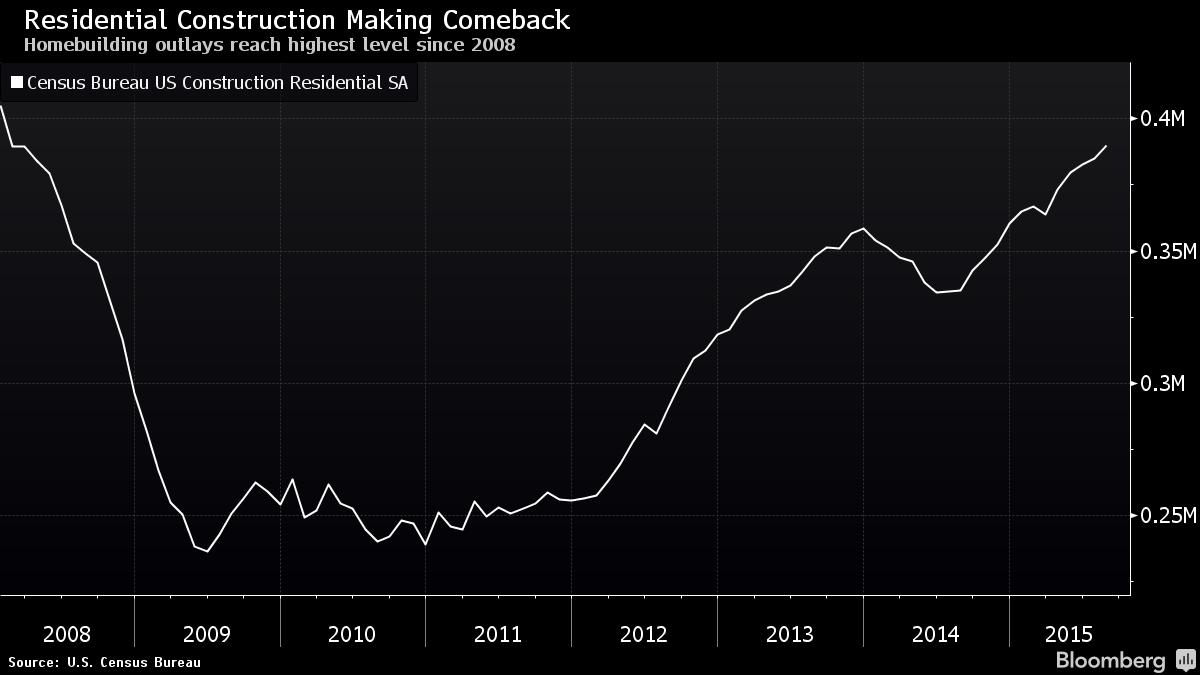

Another report Thursday showed the building industry was holding up much better. Spending on

construction projects climbed 0.7 percent in August and was up 13.7 percent since the same month last year, the biggest annual gain since March 2006.

Work on residential projects led the advance, climbing to the highest level since January 2008.

More confident American consumers are

starting families, moving into new homes and buying automobiles.

Sales of cars and light trucks last month were beating analysts’ projections, with General Motors Co. and Fiat Chrysler projecting the industry’s best month in a decade.

The Bloomberg

Consumer Comfort Index, also out Thursday, showed households last week were the most upbeat since mid-July as Americans held the most favorable views of the buying climate in three months.

One reason for the brighter moods is job security.

Firings have been hovering around the lowest levels in more than a decade and the total number of people collecting unemployment benefits earlier this month was the fewest since 2000.

Hiring is also firm. The September employment report due Friday from the Labor Department may show

payrolls climbed by about 200,000 after a 173,000 gain the prior month, and the

jobless rate probably held at 5.1 percent, the lowest since April 2008, according to the Bloomberg survey medians.