Congressional investigators are fuming over revelations that the Internal Revenue Service has lost a trove of emails to and from a central figure in the agency’s tea party controversy.

The IRS said Lois Lerner’s computer crashed in 2011, wiping out an untold number of emails that were being sought by congressional investigators. The investigators want to see all of Lerner’s emails from 2009 to 2013 as part of their probe into the way agents handled applications for tax-exempt status by tea party and other conservative groups.

Lerner headed the IRS division that processes applications for tax-exempt status. The IRS acknowledged last year that agents had improperly scrutinized applications by some conservative groups.

“Do they really expect the American people to believe that, after having withheld these emails for a year, they’re just now realizing the most critical time period is missing?” said Rep. Darrell Issa, R-Calif., chairman of the House Oversight Committee. “If there wasn’t nefarious conduct that went much higher than Lois Lerner in the IRS targeting scandal, why are they playing these games?”

The Oversight Committee is one of three congressional committees investigating the IRS over its handling of tea party applications from 2010 to 2012. The Justice Department and the IRS inspector general are also investigating.

Congressional investigators have shown that IRS officials in Washington were closely involved in the handling of tea party applications, many of which languished for more than a year without action. But so far, they have not publicly produced evidence that anyone outside the agency directed the targeting or even knew about it.

If anyone in the Obama administration outside the agency was involved, investigators were hoping for clues in Lerner’s emails.

“The fact that I am just learning about this, over a year into the investigation, is completely unacceptable and now calls into question the credibility of the IRS’ response to congressional inquiries,” said Rep. Dave Camp, R-Mich., chairman of the House Ways and Means Committee. “There needs to be an immediate investigation and forensic audit by Department of Justice as well as the inspector general.”

The IRS said technicians went to great lengths trying to recover data from Lerner’s computer in 2011. In emails provided by the IRS, technicians said they sent the computer to a forensic lab run by the agency’s criminal investigations unit. But to no avail.

The IRS was able to generate 24,000 Lerner emails from the 2009 to 2011 because Lerner had copied in other IRS employees. The agency said it pieced together the emails from the computers of 82 other IRS employees.

But an untold number are gone. Camp’s office said the missing emails are mainly ones to and from people outside the IRS, “such as the White House, Treasury, Department of Justice, FEC, or Democrat offices.”

Anti-tax advocate Grover Norquist called the episode “the worst attempt to blame technology in service of a cover-up since the infamous 18-minute gap” in former President Richard Nixon’s Watergate tapes.

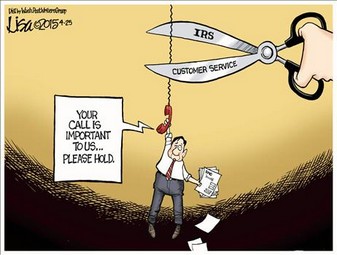

The IRS said in a statement that more than 250 IRS employees have been working to assist congressional investigations, spending nearly $10 million to produce more than 750,000 documents.

Overall, the IRS said it is producing a total of 67,000 emails to and from Lerner, covering the period from 2009 to 2013.

“The IRS is committed to working with Congress,” the IRS said in a statement. “The IRS has remained focused on being thorough and responding as quickly as possible to the wide-ranging requests from Congress while taking steps to protect underlying taxpayer information.”

Sen. Orrin Hatch of Utah, the top Republican on the Senate Finance Committee, called Friday’s disclosure “an outrageous impediment” to the committee’s investigation.

“Even more egregious is the fact we are learning about this a full year after our initial request to provide the committee with any and all documents relating to our investigation,” Hatch said.

Lerner has emerged as a key figure in the tea party probe. In May 2013, she was the first IRS official to publicly acknowledge that agents had improperly scrutinized applications.

About two weeks later, Lerner was subpoenaed to testify at a congressional hearing. But after making a brief statement in which she said she had done nothing wrong, Lerner refused to answer questions, invoking her constitutional right against self-incrimination.

The IRS placed Lerner on administrative leave shortly after the congressional hearing. She retired last fall.

In May, the House voted to hold Lerner in contempt of Congress. Her case has been turned over to the U.S. attorney for the District of Columbia.